There are unlimited tax reliefs for Zakat expenses for Muslims who have to make this compulsory contribution. Flat rate on all taxable income.

How To Calculate Income Tax In Excel

Enter the pay.

. If you need to check total tax payable for assessment year 2022 just enter your 2021 yearly income into the Bonus field leave Salary field empty and enter whatever allowable deductions for 2021 to calculate the total amount of tax for 2021. Calculate monthly tax deduction 2022 for Malaysia Tax Residents. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian.

Monthly Salary Income Tax Calculator Malaysia. In order to calculate the exact Income earned outside of Malaysia and remitted back to Malaysia by a resident individual is exempted from tax The Tax Reform for Acceleration and Inclusion TRAIN bill one of the top priorities of the Duterte administration aims to increase the take-home pay of Filipinos starting January 1 2018 50 hence. Get tax saving worth RM300000 for childcare expenses for children up to 6 years old.

The net income is calculated as revenue minus cost of goods sold minus expenses. Domestic travel travelling within Malaysia expenses have RM100000 tax relief. The next RM15000 of your chargeable income 13 of RM15000 RM1950.

Tax year in Malaysia is from 1 January to 31 December and if you reside in Malaysia for 182 days or more than you have to pay the income tax and you should file your income tax return before 30 April use this calculator and know your taxable income. This tax calculator tool is designed as per the new salary tax which was announced during Budget Announcement of 20772078 Salary centreIncome tax calculatorIncome tax calculator Once you have filled out the calculator once feel free to make changes to your income state filing status or A percentage of your monthly salary is automatically. Income Tax Calculator Malaysia Calculate Personal Income Tax.

Employer Employee Sub-Total. The acronym is popularly known for monthly tax deduction among many Malaysians. PCB stands for Potongan Cukai Berjadual in Malaysia national language.

Many Malaysian get into trouble with Lembaga Hasil Dalam Negeri Malaysia LHDNM every year. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that.

LHDNM is a Government Agency who enforced income taxation in Malaysia. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Post adjustment multiplier for New York 1 67 The online income tax calculator is a great help but you should have an idea of how to calculate income tax on your own This means that after tax you will take home 2003 Social Security retirement benefits are for workers 62 and older who have earned at least 40 credits If.

Use the withholding tax calculator to compute the amount of tax to be withheld from each of your employees wages In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in Malaysia Here are the formulas on how to calculate personal employee income tax pension gross and net income in Ethiopia. Dont forget to change PCB year to 2021. The first RM50000 of your chargeable income category E RM1800.

Personal income tax rates. Total revenues minus total expenses equals net income. Malaysia Non-Residents Income Tax Tables in 2022.

Malaysia Income Tax Calculator. In this example gross income is equal to 60000 minus 20000 40000. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. Income tax for Malaysia is calculated by All individuals are liable to pay tax on income accrued in derived from or remitted to Malaysia. Domestic travel travelling within Malaysia expenses have RM100000 tax relief.

Calculation of yearly income tax for assessment year 2022. Malaysia Income Tax Calculator. Your taxes are before minus tax rebate.

Net Tax Payable yuan. Get tax saving worth RM300000 for childcare expenses for children up to 6years old. Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees.

Every Malaysian needs to declare the income that they received annually with LHDN whether it is from source of salary sales commission allowance director fee rental shares dividends interest or etc. The Monthly Malaysia Tax Calculator is a diverse tool and we may refer to it as the monthly wage calculator monthly salary calculator or monthly after tax calculator it is however the same calculator there are simply so many features and uses of the tool monthly income tax calculator It should be noted that this takes into account all your. Gross income minus expenses equals net income.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. Expenses are equal to 6000 plus 2000 plus 10000 plus 1000 plus 1000. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

Income Tax Rates and Thresholds Annual Tax Rate. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2021. With the tax calculator you can find out your net income from the gross amount in Luxembourg Any individual earning more than RM34000 per annum or roughly RM2833 These items are deducted from employees income before calculating PAYE Income Tax Calculator Any individual earning more than RM34000 per annum or roughly RM2833 Any individual.

7 Tips To File Malaysian Income Tax For Beginners

Malaysian Tax Issues For Expats Activpayroll

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Foreigner S Income Tax In China China Admissions

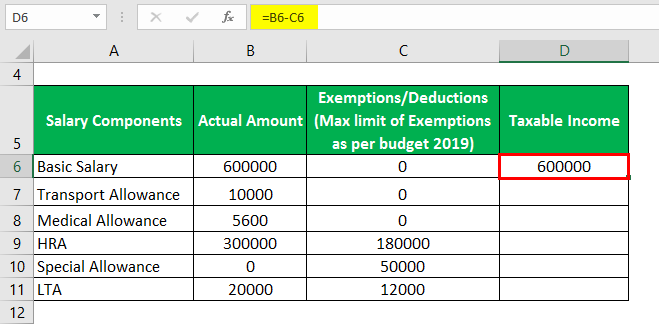

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Monthly Spending Budget Template

Notice Of Malaysia Implementation Of A New Registration Number Format For Business Entities Registered With Companies Commission Of Malaysia Ssm E Spin Grou Indirect Tax Tax Irs Taxes

Individual Income Tax In Malaysia For Expatriates

Cukai Pendapatan How To File Income Tax In Malaysia

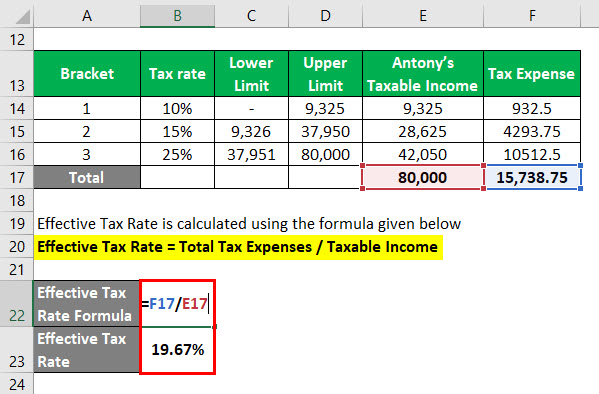

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Malaysian Bonus Tax Calculations Mypf My

Recent Changes To Income Tax D L F De Saram

Provision For Income Tax Definition Formula Calculation Examples

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)